Get in touch!

To schedule a consultation, please send us your details.

Did you know you’re eligible for numerous deductions, credits, and exemptions that could make your tax bills more affordable? Our expert tax consultants assist small and medium enterprises to capitalize on these opportunities and ensure they remain tax compliant year-round. Let’s get started!

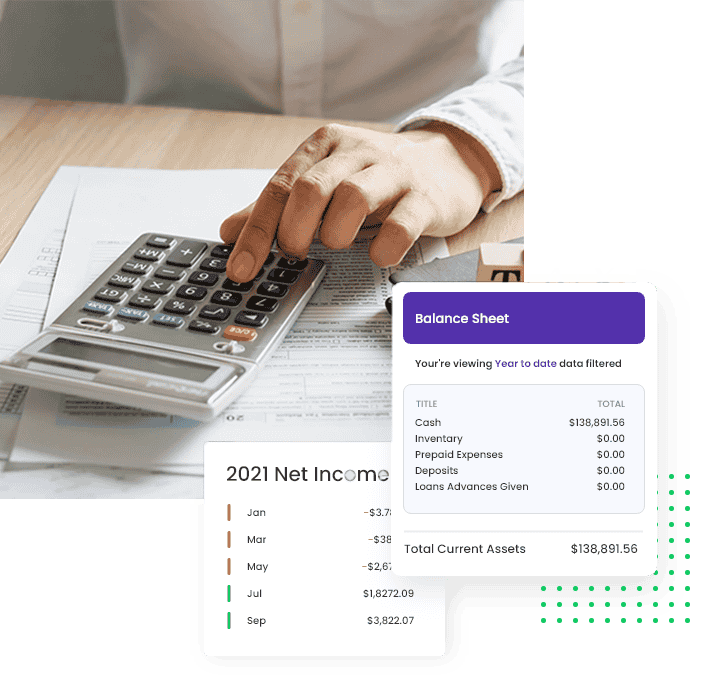

Join forces with thousands of businesses using Books And Balances INC to record transactions, recognize monetary issues, and store financial documentation. Update as you go!

We cherish our customer-centric mindset for tax preparation for small businesses struggling to plan their investments or meet their financial obligations.

Your dedicated team learns your business and connects to your financial data sources, ensuring a tailored approach to your needs and setting the stage for accurate results.

Communicate directly with your team through our user-friendly portal, where you can ask questions and provide feedback on any outstanding items needed to finalize every month.

We deliver monthly P&L, Balance Sheet, and Statement of Cash Flow reports that offer insight into your company’s financial health and enable you to make informed decisions.

We are trusted not to compromise.

Without their help, we would not have been able to scale our business as quickly as we have. They have helped us with everything from getting our bookkeeping systems in order to helping us manage our business growth. I highly recommend them for any business that needs financial support.

They have been a great financial partner to us. As a result, we have gained an incredible level of financial clarity. Moreover, they have helped us focus on our strategic priorities. They are a superb service provider, and I recommend them to others without any reservation.

I am a solo entrepreneur running a small business in the medical field. I was referred to them when I first opened my clinic and have been using their services ever since. They take care of all my bookkeeping needs and do it efficiently. The transparency of their services and affordable pricing are refreshing in this day and age.

If you’re new to Books And Balances INC, this bit should help you learn more about our platform, features, and services.

Service tax preparation is the process of calculating, reporting, and filing taxes on services provided by individuals or businesses.

Hiring a professional tax preparer ensures accurate calculations, maximizes deductions, minimizes errors, and reduces the risk of an audit.

The cost varies based on complexity, transaction volume, and the tax preparer's experience. Request a quote or discuss fees upfront.

You can, but it can be time-consuming and error-prone. Professionals ensure accuracy and compliance, while simple cases may be done independently using software or online platforms.

Drop us a line, and we’ll be sure to revert in the next 24 hours.

To schedule a consultation, please send us your details.