Taxes are an inevitable part of life, a financial responsibility that every Californian must face. Understanding how taxes work and how they impact your financial well-being is crucial. This task is even more important in the Golden State due to its unique tax system. California’s tax brackets, which determine the amount of state income tax you owe, are subject to change every year.

For the 2023-2024 tax year, it’s essential to be well-informed about these changes, as they can significantly impact your financial planning. This comprehensive guide will delve deep into the intricacies of California tax brackets 2023-2024. We will explore what tax brackets are, their functionality, and their significance in your financial life.

Understanding California Tax Brackets

Overview of California State Income Tax

California boasts one of the highest state income tax rates in the United States. The revenue generated from state income taxes helps fund various public services, including education, healthcare, and infrastructure projects. Unlike federal taxes, which are collected by the Internal Revenue Service (IRS), California state taxes are administered by the California Department of Tax and Fee Administration (CDTFA).

Tax brackets are a fundamental concept in the world of income taxation. They represent a range of income levels at which different tax rates are applied. In other words, as your income increases, you may move into a higher tax bracket, which means you will owe a higher percentage of your income in taxes.

Tax brackets facilitate a progressive tax system, where those with higher incomes pay a larger share of their earnings in taxes. Tax brackets work by applying a specific tax rate to different portions of your income.

In a progressive tax system like California’s, lower-income individuals pay a lower percentage of their income in taxes, while higher-income individuals pay a higher percentage. For instance, let’s say California has three tax brackets:

- 0% tax rate for income up to $20,000

- 5% tax rate for income between $20,001 and $50,000

- 9% tax rate for income over $50,000

If your taxable income is $60,000, you would owe:

- 0% on the first $20,000

- 5% on the next $30,000 ($50,000 – $20,000)

- 9% on the remaining $10,000 ($60,000 – $50,000)

This calculation results in a total tax liability of $3500

($20,000 * 0%) + ($30,000 * 5%) + ($10,000 * 9%) = $3,500.

California Tax Brackets for 2023-2024

Worried About Tax Season?

Say goodbye to stress and let us manage your

numbers with meticulous care.

California typically has a range of tax brackets, each with its associated tax rate. These brackets are designed to distribute the tax burden fairly among residents with varying income levels. Here’s an example of what California’s tax brackets for 2023-2024 might look like:

- 1.0% tax rate for income up to $8,544

- 2.0% tax rate for income between $8,545 and $20,255

- 4.0% tax rate for income between $20,256 and $31,969

- 6.0% tax rate for income between $31,970 and $44,377

- 8.0% tax rate for income between $44,378 and $56,085

- 9.3% tax rate for income between $56,086 and $286,492

- 10.3% tax rate for income over $286,493

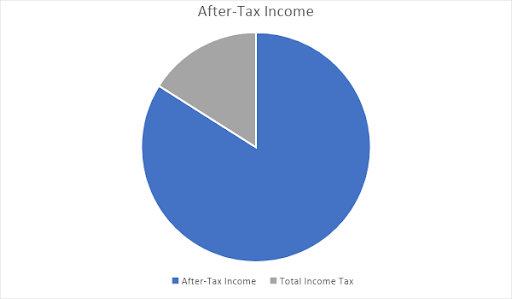

If you make $70,000 a year living in California, you will be taxed $11,221. This corresponds to an average tax rate of 11.67%, with a marginal tax rate of 22%. This marginal tax rate means that your immediate additional income will be taxed at this rate.

| Federal Taxes

22% Marginal Tax Rate 11.67% Effective Tax Rate $8,168 Federal Income Tax State Taxes 9.3% Marginal Tax Rate 4.36% Effective Tax Rate $3,054 California State Tax ______________________ Gross Income $70,000 Total Income Tax -$11,221 After-Tax Income $58,779 |

Calculating Hypothetical Tax Liability

Calculating Hypothetical Tax Liability

To illustrate how these tax brackets work, let’s calculate the hypothetical tax liability for individuals with different income levels. We’ll use the tax brackets provided above to demonstrate the process.

- Example 1: An individual with a taxable income of $15,000 falls into the 2.0% tax bracket. Their tax liability would be $300 (($15,000 – $8,544) * 2.0%).

- Example 2: A person earning $45,000 falls into the 8.0% tax bracket. Their tax liability would be $3,122 (($45,000 – $44,378) * 8.0%).

- Example 3: Someone with a taxable income of $300,000 falls into the 9.3% tax bracket. Their tax liability would be $25,827 (($300,000 – $286,492) * 9.3%).

These examples highlight how tax brackets operate and how your tax liability can vary depending on your income.

Comparison with Federal Income Tax

It’s important to note that California state taxes are separate from federal income taxes. While federal tax brackets apply to income earned across the entire country, California state tax brackets are specific to the state. Therefore, you must consider both federal and state taxes when calculating your overall tax liability.

Tax authorities typically announce changes to tax brackets well in advance of the tax year. Economic factors, legislative decisions, or adjustments for inflation may influence these changes. Staying informed about these changes is essential for accurate tax planning.

Tailored Solutions to

Your Business

Needs

We believe that each business is unique, which is

why we tailor our bookkeeping services to meet your

specific needs. From companies to established businesses,

we have your back!

Contact-Us

Legislative Reforms and Inflation Adjustments

Legislative reforms can have a significant impact on tax brackets. Changes in tax laws, deductions, credits, and exemptions can affect the overall tax liability of Californians. Remember to pay attention to any legislative developments that could impact your taxes.

Tax brackets are often adjusted for inflation to ensure that individuals are not inadvertently pushed into higher tax brackets due to rising incomes. Understanding how inflation adjustments are made can help you anticipate changes in your tax liability.

How Hiring a Professional Helps

Navigating California’s tax system can be complex, particularly in conjunction with federal taxes. This is where hiring a tax professional can make a substantial difference. Benefits of hiring a tax professional may include:

- Expertise: Tax professionals are well-versed in tax laws and regulations. They stay up-to-date with changes and can provide accurate advice.

- Maximizing Deductions: Tax professionals know how to identify deductions and credits you might overlook, potentially saving you money.

- Audit Support: If you face an audit, a tax professional can provide valuable support and guidance throughout the process.

- Time Savings: Tax professionals can save you time and reduce the stress of preparing and filing your taxes.

- Customized Advice: They can provide personalized tax strategies tailored to your specific financial situation.

- Complex Scenarios: For individuals with complex financial situations, such as business owners or those with multiple sources of income, tax professionals can navigate intricate tax scenarios effectively.

Lighten Your Load with

Affordable BookKeeping

Packages

We offer competitive packages that won’t break the bank,

and up-front pricing so you know exactly what you’re getting

as your return on investment.

Conclusion

Navigating California’s tax system, especially the state’s tax brackets for 2023-2024, can be challenging. However, armed with knowledge, careful planning, and perhaps the assistance of a tax professional, you can navigate the complexities and make informed decisions to optimize your tax situation.

If you are looking to hire a tax professional, at Books and Balances Inc., we offer tax planning and preparing, along with CFO, payroll, bookkeeping, and LLC registration services.