Ever wondered what it takes for a business to reach its break-even? Beyond simply generating sales, key financial indicators play a vital role in determining when profitability starts kicking in.

In this blog, we will delve into the process of Using the Contribution Margin and Gross Profit to Calculate Break Even. Whether you aspire to start your own business or are simply curious about the inner workings of a company’s finances, this exploration will shed light on the intricate calculations involved in determining when revenues equal expenses and profits begin to roll in.

Understanding Contribution Margin

Contribution Margin is a crucial financial metric that can offer businesses valuable insights into their profitability. It represents the amount of revenue available to cover fixed costs and contribute to profits after deducting variable costs linked to producing or delivering a product or service.

One important aspect of contribution margin is its ability to reveal the proportion of each dollar in sales that contributes directly to profits. This insight empowers businesses to identify products or services that yield higher margins and those that may be less profitable. Organizations can optimize their product mix and marketing strategies by focusing on high-margin items, potentially boosting overall profitability.

The contribution margin can be calculated using a simple formula:

Contribution Margin = Total Revenue – Total Variable Costs

The significance of contribution margin lies in its capacity to guide strategic decisions. It offers insights into pricing strategies, cost control measures, and the overall financial viability of a product or service. Businesses with a healthy contribution margin have greater flexibility in covering fixed costs and generating profit, making it an essential tool for informed decision-making. The contribution margin also empowers entrepreneurs and managers to make informed pricing, resource allocation, and operational efficiency decisions.

It’s an essential metric in the toolkit of a remote account manager or anyone responsible for managing a business’s finances. Some businesses hire part-time bookkeepers or use bookkeeper-on-demand services to ensure accurate calculations and informed decisions. This approach provides access to financial expertise as needed while maintaining financial agility in a competitive market.

Understanding Gross Margin

Gross profit is another fundamental financial metric representing the difference between a company’s total revenue and its cost of goods sold (COGS). It reflects the amount of money a business retains after accounting for the direct costs associated with producing or purchasing its products or services.

To calculate gross profit, you subtract the cost of goods sold (which includes expenses like materials, labor, and manufacturing costs) from your total revenue.

The gross margin can be calculated using the following formula:

Gross Profit = Total Revenue – Cost of Goods Sold

Gross profit stands as a critical indicator of a company’s operational efficiency and profitability. It offers insights into the core profitability of a company’s products or services. A positive gross profit indicates that a business is generating revenue above the direct costs of production.

Monitoring gross profit is essential for sustainable growth and financial well-being. Understanding gross profit is crucial whether you’re a remote account manager overseeing a company’s financial performance or a small business owner. Hire part time bookkeepers so they can ensure accurate tracking of expenses and revenue, which, in turn, helps maximize gross profit and overall profitability.

Worried About Tax Season?

Say goodbye to stress and let us manage your

numbers with meticulous care.

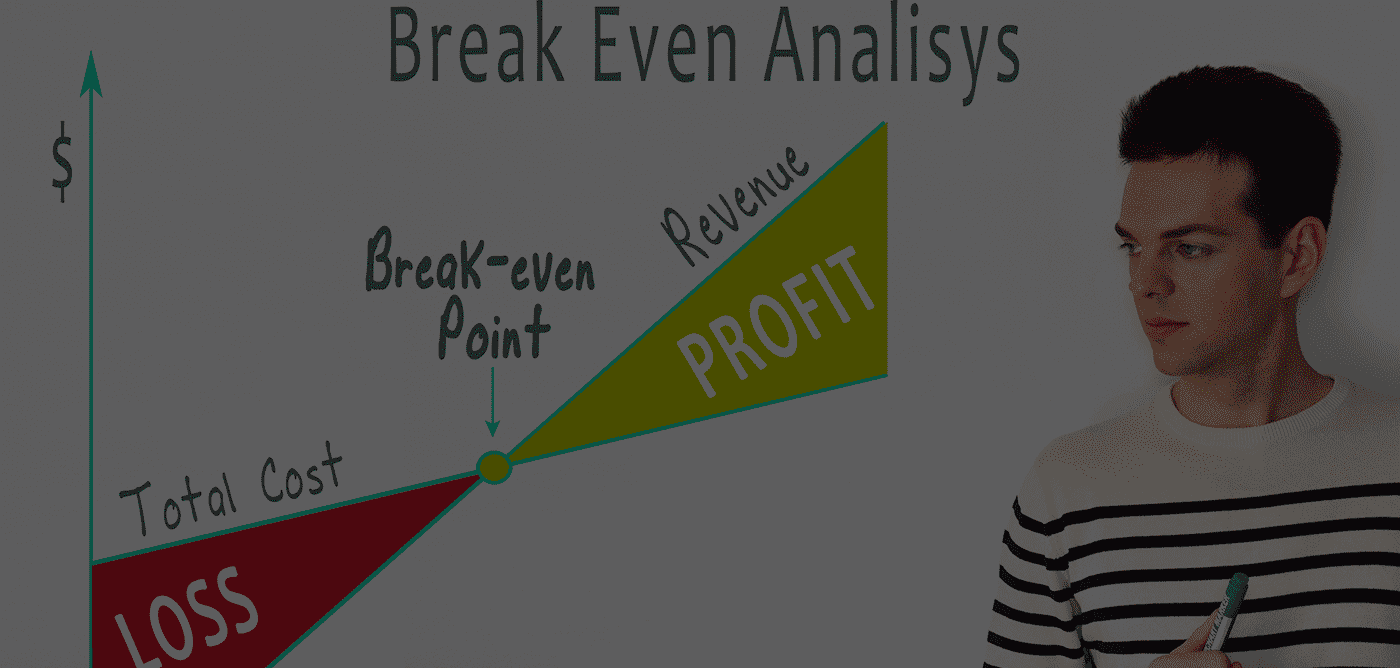

Break Even Analysis

The break-even point is a pivotal financial milestone where a business covers all its fixed and variable costs, resulting in zero profit or loss. It signifies the level of sales or revenue at which a company neither makes money nor incurs losses.

Break-even analysis holds immense significance as it aids businesses in determining the minimum level of sales or revenue required to cover costs. It’s a powerful tool for assessing the financial viability of a product or service and making strategic decisions. Break-even analysis assists in setting pricing strategies and managing expenses, ensuring a sustainable business model.

How Break-Even Point Relates to Contribution Margin and Gross Profit

The break-even point is inherently intertwined with both contribution margin and gross profit. The contribution margin reveals the portion of revenue available to contribute to fixed costs and profit.

A comprehensive understanding of contribution margin helps businesses determine the number of units or services they must sell to reach the break-even point. In contrast, gross profit factors into the calculation of fixed costs, which constitute an integral component of break-even analysis.

The interplay between break-even analysis, contribution margin, and gross profit is essential for a remote account manager or someone overseeing a business’s financial performance.

It facilitates informed decisions regarding pricing, cost control, and resource allocation. Some businesses hire part-time bookkeepers or utilize bookkeeper-on-demand services to maintain accurate financial records, which are essential for conducting effective break-even analysis and ensuring long-term financial stability.

Using Contribution Margin to Calculate Break Even

Here’s a step-by-step guide to calculating the break-even point using the contribution margin:

- Determine Fixed Costs: Start by identifying all your fixed costs. These expenses remain constant irrespective of your production or sales level. Common examples include rent, salaries, and insurance premiums. Ensure you have an accurate list of these costs.

- Calculating Contribution Margin Ratio: To calculate your Contribution Margin Ratio, subtract the total variable costs from the total revenue and divide the result by the total revenue.

Contribution Margin Ratio = (Total Revenue – Total Variable Costs) / Total Revenue

This ratio represents the proportion of each sale that covers fixed costs and generates profit.

- Applying the Formula: Now, you can use the Contribution Margin Ratio to calculate your break-even point. The break-even point (in units) is equal to the fixed costs divided by the Contribution Margin Ratio.

The formula for calculating the break-even point is:

Break-Even Point (in units) = Fixed Costs / Contribution Margin Ratio

This method provides a clear numerical value for your break-even point in terms of units sold. It helps you understand how many units or products you need to sell to cover all your fixed costs and start generating profit. This information is invaluable for setting sales targets, pricing strategies, and overall business planning.

By understanding and using the contribution margin to calculate the break-even point, you can make informed decisions as a business owner, manager, or remote account manager. It enables you to assess your pricing structure, cost control measures, and profit margins, ultimately contributing to your business’s financial health and sustainability.

Tailored Solutions to

Your Business

Needs

We believe that each business is unique, which is

why we tailor our bookkeeping services to meet your

specific needs. From companies to established businesses,

we have your back!

Contact-Us

Using Gross Profit to Calculate Break Even

Here’s a step-by-step guide to calculating the break-even point using gross profit:

Step 1: Identify Total Revenue: Begin by determining your total revenue. It represents the total income generated from sale of your products or services over a specific period. Ensure that this figure is accurate and up-to-date.

Step 2: Deduct Total Variable Costs: Next, subtract your total variable costs from the total revenue. Variable costs are expenses directly associated with producing or delivering your products or services.

The formula for gross profit is:

Gross Profit = Total Revenue – Total Variable Costs.

Step 3: Determine Gross Profit Margin Calculate your Gross Profit Margin by dividing the Gross Profit (from Step 2) by the Total Revenue (from Step 1). The Gross Profit Margin is expressed as a percentage and represents the portion of each sale that contributes to covering fixed costs and generating profit.

Step 4: Calculating Break-Even Point To calculate the break-even point, you need to know your Fixed Costs. These are the expenses that remain constant regardless of your level of production or sales. Examples include rent, salaries, and insurance.

The formula for calculating the break-even point (in units or dollars) is:

Break-Even Point = Fixed Costs / Gross Profit Margin.

This method offers a clear explanation of when your business will start making a profit and how many units or dollars in sales are required to cover your fixed costs. It’s valuable for decision-making, pricing strategies, and financial planning.

As a business owner, manager, or remote account manager, understanding how to use gross profit to calculate the break-even point empowers you to make informed financial decisions. It enables you to assess your profitability and develop strategies to reach and exceed the break-even point, ultimately contributing to your business’s financial success and sustainability.

Lighten Your Load with

Affordable BookKeeping

Packages

We offer competitive packages that won’t break the bank,

and up-front pricing so you know exactly what you’re getting

as your return on investment.

Tips for Effective Break-Even Analysis

-

Keep Data Updated:

Regularly update your financial data to ensure that fixed costs, variable costs, and revenue figures reflect current conditions. Frequent updates enable you to make informed decisions based on real-time financial information.

-

Consider Market Changes:

Be vigilant about changes in the market, industry, or customer preferences. Shifts in demand, pricing structures, or competition can impact your break-even point. Stay flexible and adjust your analysis accordingly to adapt to market fluctuations.

-

Use Software Tools for Analysis:

Leverage specialized software tools and financial modeling software for break-even analysis. These tools can streamline the process, perform complex calculations, and provide visual representations of your break-even point, making it easier to understand and communicate with stakeholders.

By following these tips, you can enhance the accuracy and effectiveness of your break-even analysis. Whether you’re a business owner, manager, or remote account manager, these practices will help you make more informed financial decisions and successfully navigate the dynamic business environment.

Benefits Of Hiring Bookkeeper On Demand

Hiring a bookkeeper on demand, especially for calculating contribution margin and gross profit to determine the break-even point, can offer several significant benefits for businesses:

- Expertise and Accuracy: Bookkeepers are trained professionals with financial record-keeping and analysis expertise. When calculating contribution margin or gross profit, accuracy is paramount, and a skilled bookkeeper can ensure precise calculations.

- Time Efficiency: Break-even analysis requires meticulous data collection and calculation. Outsourcing this task to a bookkeeper on demand allows business owners and managers to save time and focus on other critical aspects of their operations, such as strategic planning and customer engagement.

- Flexibility: Hiring a bookkeeper on demand provides flexibility in terms of when and how often you require their services. You can engage their expertise on an as-needed basis, optimizing costs while maintaining financial agility.

- Access to Technology: Many bookkeepers utilize advanced accounting software and tools to streamline the calculation process, generate reports, and visually represent financial data. This technology can enhance the accuracy and efficiency of break-even analysis.

- Financial Insight: Beyond number crunching, a skilled bookkeeper can provide valuable financial insights and recommendations based on the results of break-even analysis. They can help identify cost-saving opportunities and strategies to improve profitability.

- Confidentiality and Compliance: Professional bookkeepers are well-versed in maintaining the confidentiality of financial data and ensuring compliance with accounting standards and regulations. This ensures the integrity of your financial information.

- Customized Reporting: A bookkeeper can tailor the reporting of contribution margin and gross profit analysis to suit your specific business needs. This customized approach ensures that the analysis is directly applicable to your unique circumstances.

- Cost Efficiency: Hiring a bookkeeper on demand can be cost-effective compared to having a full-time, in-house accounting staff. You only pay for the services you require, reducing overhead expenses.

- Scalability: As your business grows or faces changes in demand, you can scale up or down your engagement with a bookkeeper on demand, ensuring that you have the support you need without unnecessary financial commitments.

Hiring a bookkeeper on demand can be a strategic move for businesses aiming to calculate the contribution margin and gross profit for break-even analysis. It combines financial expertise, flexibility, and cost efficiency to ensure accurate and insightful financial assessments, ultimately contributing to better decision-making and financial stability.

Wrapping up

Grasping the concepts of contribution margin and gross profit and utilizing them to calculate the break-even point is instrumental in guiding businesses toward financial success. These analytical tools empower entrepreneurs, managers, and financial professionals like remote account managers to make well-informed decisions that impact the bottom line.

In a world where financial acumen is essential for business survival and growth, harnessing the power of these financial metrics and seeking professional assistance from trusted partners like Books And Balances Inc can be the catalyst for achieving long-term financial stability and success. So, whether you’re a seasoned entrepreneur or a remote account manager, embrace the wisdom of our financial experts to thrive in the dynamic business world.